Is your retirement in danger?

Short answer: Yes.

In this article, I'll explain why your retirement is in danger along with an explanation of how passive funds work, the number behind fund management, and how stocks can hit zero.

P.S.: I want to clarify, I'm not saying don't buy ETF's or Index Funds, just that you need to be cognizant of how the market is currently structured and the additional risks that come along with it.

Most people have never even thought about the roll passive funds have played in US stocks being wildly expensive. If you're considering buying a passive investment make sure you understand the underlying assets very well.

Lastly, I'd consider having some portion of your portfolio long volatility and in assets that have zero correlation with stocks. i.e. gold/silver bitcoin.

For more discussion of these types of topics check out Rebel Capitalist Pro.

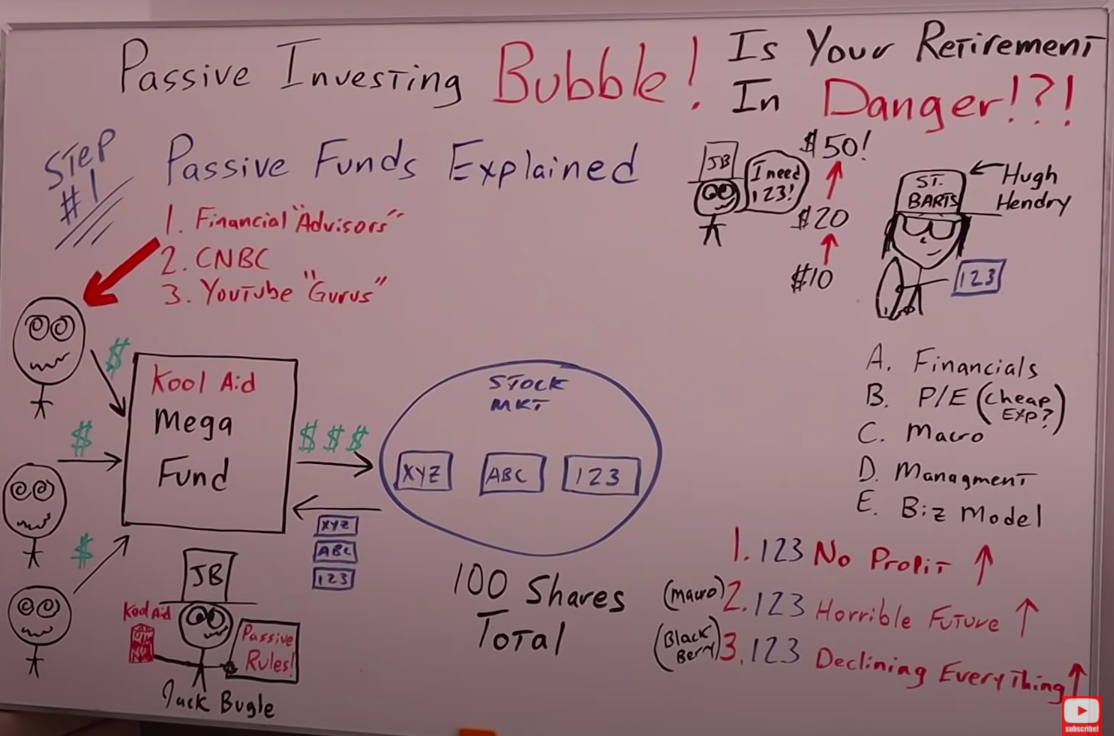

How Passive Funds Work

Your retirement is under extreme danger, and I'm going to reveal why, so let's go over the basics of how passive funds work.

It starts off with the financial advisers, people on CNBC, and the YouTube gurus that say, “Listen, forget all that active management. You don't need to pay those fees. Just go into one of these passive index funds. It just puts your money in and mimics the S&P 500. That's all you need to do. Just set it and forget it. And in 20 or 30 years, when you retire, you're going to be rich.”

People buy into that. They get brainwashed into thinking they can have a higher return without doing any work themselves or without an active manager having to do work for them.

They say “There's no need to study the fundamentals. There's no need to look at profit or returns or future potential for a business. Who needs that? All you have to do is buy the whole thing.”

As an example, before Jack Bogle passed away, one of his famous sayings was, “You don't have to find a needle in a haystack. Just buy the whole haystack,” right? It's easy.

People buy into that nonsense and they put their money straight into this megafund. I call it the Kool-Aid megafund, and you can see it on this next whiteboard.

I call it the Kool-Aid megafund because, of course, they're all drinking the Kool-Aid. I drew some characters into the story like JB on the bottom with the hat. We'll call him Jack Bugle.

Jack Bugler runs the fund and is holding a sign that says, “Passive rules!.” He's handing out the Kool-Aid like it's going out of style.

Let's think through JBs process of how he determines which stocks he's going to buy and which he's going to sell. It's pretty easy. There is no process.

Every dollar that comes into the fund just goes directly into the stock market and buys the underlying assets.

The only decision process they have is if a dollar comes in, a dollar has to buy. If a dollar goes out, a dollar has to sell.

The problem with this is that it wildly distorts the market itself and it creates a total disconnect between prices and the underlying fundamentals of the stocks or the assets themselves.

Here's how it works. Look at the blue circle on the whiteboard, it represents a small stock market that has company XYZ, ABC, and 123. We'll say there are only a hundred shares in total.

If money comes into the Koolaid Mega fund, JB has to buy at least one share of the companies because his fund represents the stock market. It's a reflection of this market.

The individual in the right upper corner is an active manager. His name is Hugh Hendry, a good buddy of mine from St. Barts. Hugh is chilling with his surfboard and his share of company 123.

Now, Hugh may be a great guy, fun to hang out with, that's for sure, but he is a very shrewd, active manager, a smart guy. He bought the share of 123 at, let's say, $10 because of the financials, the PE ratio.

Was it cheap? Was it expensive? He looked at the macro picture, the management of the company, and their business model. But JB doesn't care about any of that.

If 123 has no profit, no problem, he still has to buy. If the macroeconomic picture doesn't look good, let's say due to the Coronavirus, and 123 has a horrible future, no problem.

JB still has to buy or like Blackberry, if 123 just had declining everything, no problem. JB still has to buy and Hugh being the sophisticated investor he is, knows this.

If he bought the stock for $10, that's its fair market value, JB comes in and says, “Hugh, I'll give you $20 for that share.”

Hugh then says, “No, I don't think so.” JB says, “I'll give you $50, $100. I'll give you $500 for that share of 123 because I have to buy it regardless of the price.”

The transaction happens. Now JB has the shares he needs, so his fund reflects the underlying asset, but now there is a huge disconnect.

If a high enough percentage of assets go from active to passive the tail wags the dog.

Let me explain it this way. The passive fund is supposed to track the performance of the underlying asset, but now the performance of the underlying asset tracks the fund.

The Numbers Behind Fund Management

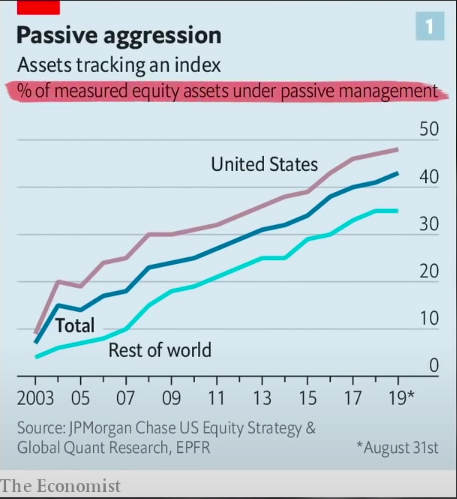

Let's go over the numbers, but I warn you… they are shocking! To say the least. Here is the percentage of measured equity assets under passive management.

Look at the red line which represents the United States, I’m going to focus there. In 2003 it was under 10%, but it's gone up to almost 50% since then. Let that sink in a moment.

According to the Economist, almost 50% of the equity assets under management are managed by a passive fund that has no decision-making process whatsoever.

There is zero analysis other than if money comes in. They buy and if the money goes out, they sell.

How can we expect the stock market to reflect the underlying fundamentals of the economy if almost 50% of the people who are buying aren't paying attention to the fundamentals at all?

But wait, there is more.

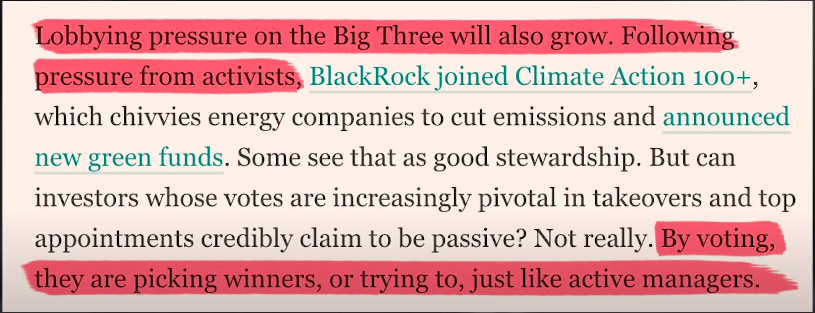

“Vanguard and its two peers,” who are BlackRock and State Street, “manage assets worth $15 trillion.” “BlackRock” itself, “the largest of the Big Three, has increased client assets 20 times to over $7 trillion just over the past 15 years.”

We haven't even talked about moral hazard.

These funds aren't just indiscriminately buying shares. They're also buying shareholder votes.

Let's keep that in mind. When Jack Bogle of Vanguard, not to be confused with Jack Bugle of the Koolaid megafund, passed away last year, he wrote the following:

If index funds owned more than 50% of the stock market, it would not serve the national interest.

That is a dramatic understatement, to say the least.

How Stocks Can Go To Zero

I know a lot of you right now are saying, “George takeoff that tin foil hat. What are you talking about?” I would challenge you to hear me out, but make sure you're sitting down.

The whole process of how passive funds work can flow in reverse order.

We talked about the average Joe and Jane that's sitting like a zombie and has been brainwashed by all the YouTube gurus and financial advisors who are just giving their money to the Kool-Aid fund. We discussed that.

But what happens when those average Joes and Janes start taking their money out of the Koolaid megafund?

What does JB have to do?

- Maybe we can have demographics issues. We have all the Baby Boomers retiring. Well, they need that money to live.

- We might have panic in the market like March of 2020.

- Generational issues. We have a gradual outflow from the Baby Boomers while that capital and those assets aren't replenished by the Millennials that don't have the money.

They're straddled down by things like student debt. They were crushed in the GFC. The job market isn't what it was, especially now after the Coronavirus

It doesn't matter if there's money coming in and money going out.

It matters about on net balance, is there more money going in or is there more money going out?

So let's assume now it's in reverse. There's more money flowing out of the Koolaid megafund. To understand what would happen next, here is part of one of my favorite podcasts, which this whole whiteboard video is based on.

An episode from the End Game with Grant Williams, Bill Fleckenstein, and Mike Green.

Mike Green: The problem with that is that simultaneously, it also takes the volatility through the roof.

If you think about what happens when you're making that last move, where you're going from 99.9% passive to 100% passive, what price changes are required to get that last active holder to sell?

Its volatility like you can't even begin to imagine to the top side. But what happens if you were there?

You're at 99.9% passive, 0.1% active, and for some reason, the passive decided to sell 1%. What happens to prices?

Bill Fleckenstein: Yeah. Limit down? I don't know.

Mike Green: Beyond the limit down.

Grant Williams: There's no bid for them, right?

Mike Green: That's what markets are, right?

Markets are the solution for transactions.

The price that you see is the intersection of supply and demand not in some theoretical sense, it's the point at which buyers and sellers were able to meet and balance that book.

Well, if there are no discretionary buyers that are capable of meeting the 1% redemption because they only have 0.1% of the capital, there's no price at which that market can clear except zero.

(End of transcript)

Let's unpack this a little further so you can connect the dots.

The passive funds drive prices way higher than they otherwise would if left to the active managers alone.

Remember it goes from 10 to 100 up to $500 and JB has to buy it any price. This creates the epic volatility Mike Green was talking about.

But if JB has net outflows, meaning more people are taking money out of the Koolaid megafund, he has to sell at any price.

Imagine he has a share of 123 he originally bought from Hugh, and Hugh likes the share, but he doesn't like it at 500. He likes it at $10.

You would have the opposite volatility or instead of the price going way higher than it otherwise would, it would completely crash down to a price way lower than where it currently is.

Let's think this through. Hugh likes the price at 10, but currently, it's at 500. JB goes to Hugh and says, “Hugh, you have to bail me out. I have to sell, I'll sell it to you for maybe $100.”

Hugh looks at him and says, “No, I don't think so. I have my original 500 dollars. I'd rather keep it in my back pocket.”

JB says, “Fine Hugh. I'll sell it back at $10. I'll take a $490 loss just on this transaction.” Hugh says, “Oh, okay. I'll buy it for $10.”

That is massive volatility to the downside and a huge haircut, not only for the fund but for the people who are invested in the fund, the passive investors, that average Joe and Janes that drank the Kool-Aid.

The main takeaway is that active managers would put in a bid far lower than the current price.

According to Mike Green, this was one of the big reasons we saw so much downside volatility back in March, but it also doesn't take into consideration the percentage of assets we talked about before.

Let's just, as a thought experiment, take it to an extreme.

Like Mike was talking about, where Hugh, the active managers, maybe only have 0.1% of the assets, and 99.9% are now under the management of these passive fund guys like JB.

I want to be clear, it doesn't necessarily have to be 99.9 and 0.1. We don't know where the line in the sand is. It could be at 60-40, 80-20, we just don't know.

The bottom line is these passive people, the outflows, would exceed the amount of assets under management with the active fund guys.

To put it into simple terms, if JB has a thousand dollars worth of outflows, he has to come up with the thousand dollars by selling stocks.

Let's say that Hugh or the active managers only have $500, think about that, they don't have enough money in order for JB to satisfy his redemptions from the average Joe and Jane that are taking their money out.

What happens to the bid and to the price of the stocks that JB is trying to sell?

There isn't a bid. There is absolutely no price at which those stocks will clear. In other words, they go to zero.

Comments are closed.