What's The Future of Oil Prices Looking Like? Is oil worth $120,000 a barrel?

We are a society of consumers, and consumption cannot happen without ample production of the things we consume. But, how can we produce ample things when the energy-dense oil we pull out of the ground is compromised?

Oil is simply the most energy-dense product available in mass quantities. Without it, our quality of life will be dramatically reduced.

If you believe we'll choose to use oil, versus falling into a global depression that will last for decades, then you must also believe the price of oil will (at some point) be higher than the cost to produce it.

And here's where it gets interesting, we all know oil will most likely be higher long term, but how much higher? $50, $100, $200 a barrel?

Those are the questions about the future of oil prices I explore in this article.

1. What can we learn from past oil prices?

2. What are the past and current costs to produce oil?

3. What is the actual value of oil and what could cause oil prices in the future to rise?

If you're interested in oil, commodities, gold, silver, and the future of the economy this is a must-read. You can also continue on your commodities journey by checking out this Jim Rogers interview.

The Past Price Of Oil

Let's talk about the past price of oil. We're going to do exactly what Jim Rogers has taught us to do by pulling up a chart and asking ourselves…

Why has a commodity or price of anything has spiked in the past?

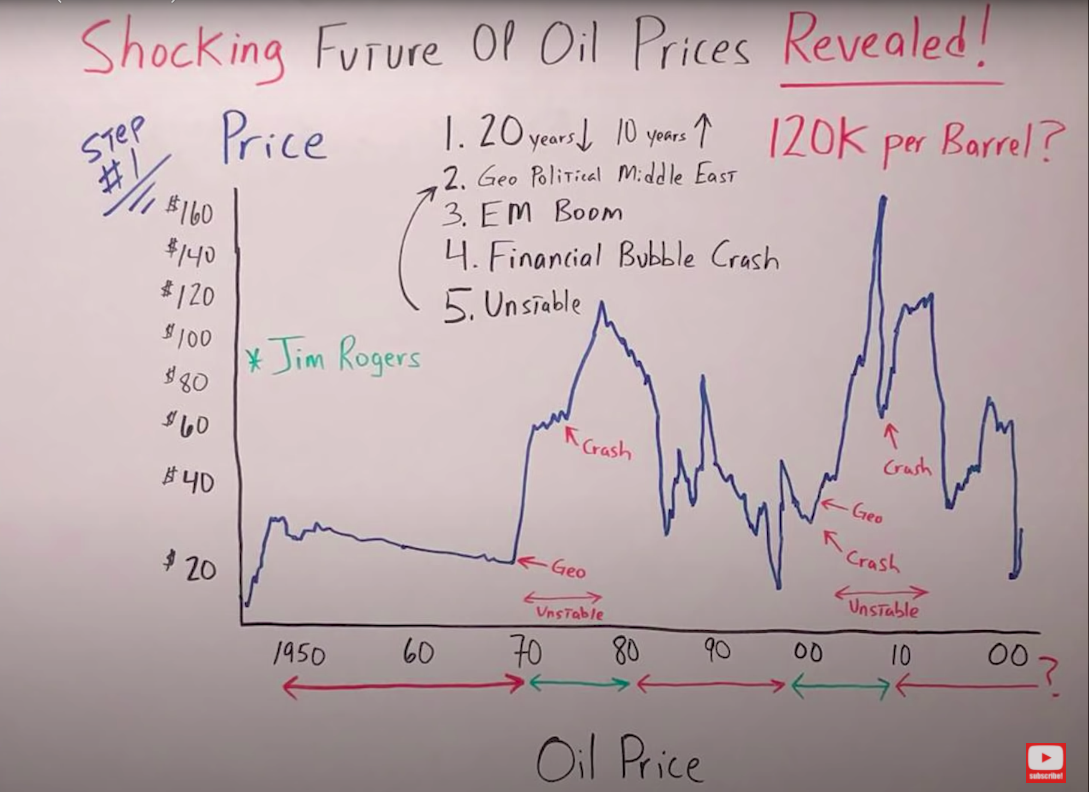

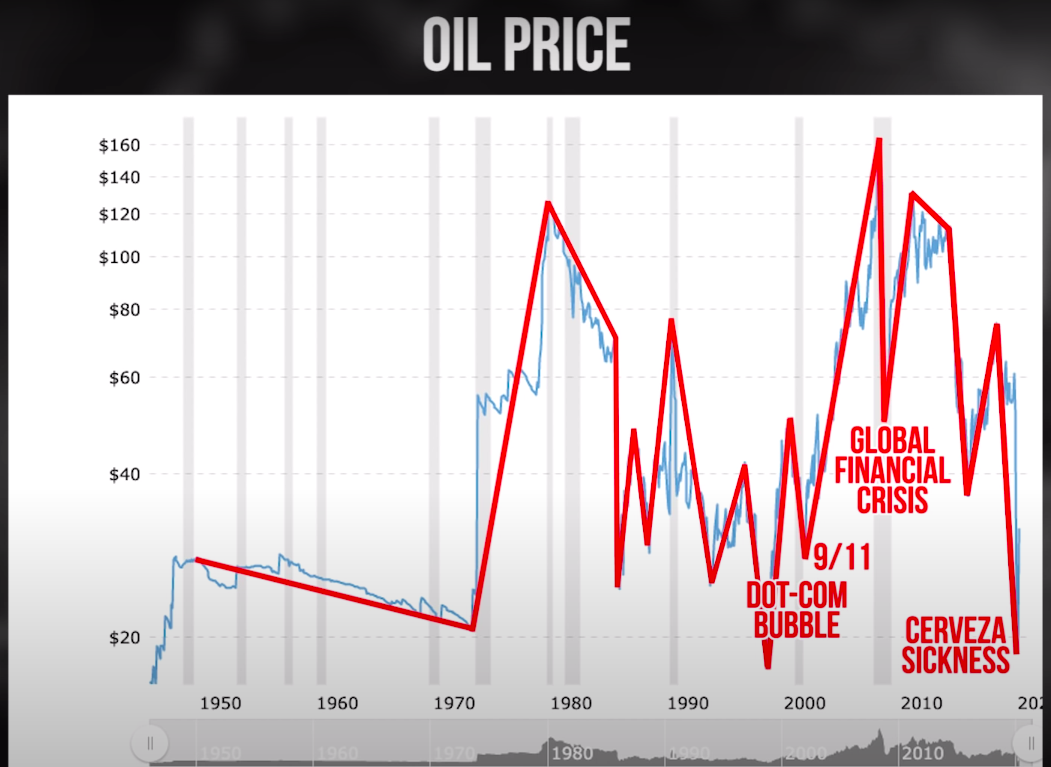

Let's start with the following chart, first my drawing, then, the original chart.

It goes back to 1950 all the way to 2000. On the left, it goes from $20 a barrel all the way up to $160.

Please keep in mind, this is adjusted for inflation.

In 1950, oil was about 30 dollars a barrel. It went down to about 20 dollars a barrel in 1970, and then it really went parabolic from 1970 to 1980, all the way up to almost 120 dollars.

Then, it went on a 20-year bear market. From around 1979 to 1980 and all the way to 1998, where it got under $20 a barrel.

It went up a bit, and later the dot com bust and 9/11 happened. It went parabolic again, up over $160 a barrel adjusted for inflation.

It collapsed during the GFC and it went up a bit in 2010/11, but then, again, it came all the way down.

Now, we know what happened recently with the coronavirus, and that took it to $20 a barrel again.

What can we learn from this chart?

- Oil tends to move in these 20-year or 10-year cycles. It goes down for about 20 years then up for 10 years. And you can see that indicated by the red and green arrows beneath the chart.

- The catalyst for a bull market in oil always seems to be some sort of geopolitical event in the Middle East.

Let me be clear, I'm not saying the future is going to look exactly like the past.

What I am saying is…

We need to analyze the past and look for catalysts, so we can better determine what the probabilities of oil going up or down in the future are.

I want to point out that in the bull market between 2000 and 2012, we had a huge boom in emerging markets, a lot of demand for oil and commodities in general.

But going back to geopolitics, just for a moment, if you look at the last two bull markets in oil, there always seems to be consistent instability.

The biggest takeaway from this chart is in the past, where we've seen big moves in oil upward. We've seen a stock market or an asset bubble come crashing down.

From the 1970s to 1974, the stock market went down by over 60%. Most people don't remember that.

In 2000, 2001, the dot-com bust happened, and then in 2008/9, the GFC brought the stock market down by 50%.

To understand why this happens, look at some definitions.

The 2000s commodities boom was created following the collapse of the mid-2000s housing bubble.Commodities were seen as a safe bet after the bubble economy surrounding housing prices had gone from boom to bust in several western nations, including the UK, US, Ireland, Greece, Spain. Advisers claim that commodity prices could be better predicted than stocks, since they're traded for actual usage and the price is based on supply and demand, while stocks are bought for speculation and news immediately influence prices. Still commodity prices have fluctuated outside predictions.

Wikipedia

Sounds very similar to what's happening today. We have huge asset bubbles that could be collapsing in on themselves.

Will people move to commodities because they see them safer, something tangible, that's in the real economy and they want nothing to do with these financial assets that have been created by the Fed quantitative easing, funny money, and financial engineering?

That we'll have to explore in the rest of the article.

The Cost To Get Oil Out Of The Ground

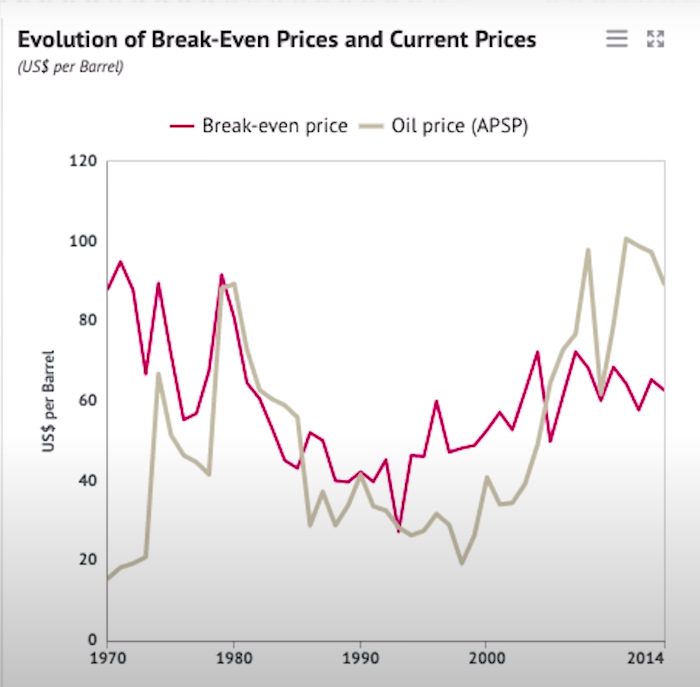

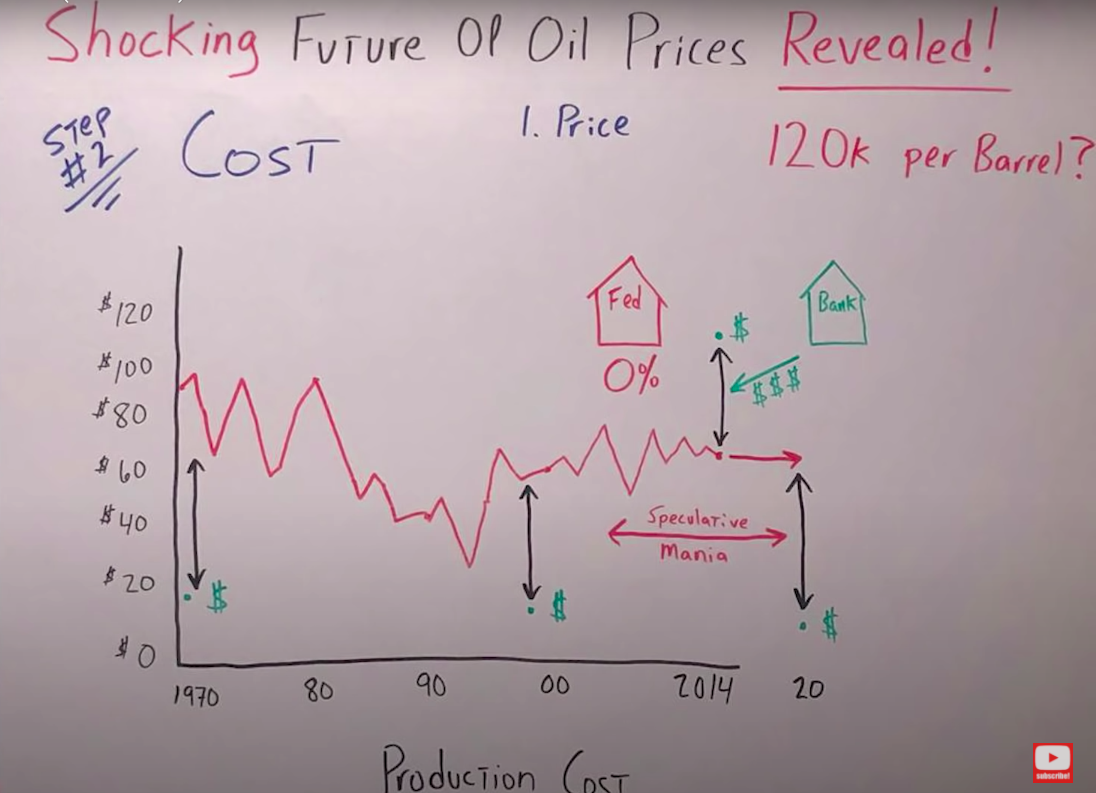

Here is a chart going back to 1970 all the way to 2014, but I've taken it to 2020 in my whiteboard.

On the left, you can see the price of oil goes from $0 a barrel all the way up to $120 a barrel. In 1970 it was extremely expensive to produce a barrel of oil, almost 100 dollars.

It went up and down, but in 1980 it went back to near $100.

One thing I want to point out here is in 1970, the price of oil went all the way down under $20 a barrel adjusted for inflation.

So is it any surprise that the price of oil went through the roof?

From 1980, all the way to the mid-90s, the production costs plummeted till it got to near $20 a barrel, they spiked back up.

Then in 1998, again, there was a huge discrepancy between the cost, around $60 a barrel, and the price under $20 a barrel again.

But in 2014, the exact opposite happened. The cost was still around 60 dollars a barrel, but the price was up over $100 a barrel.

This is when there was a speculative mania in the stock market because the Fed had dropped interest rates all the way down to zero for almost a decade.

The banks see all this money being made in the oil space, so what do they do? They throw money at anyone producing oil. They want to get in on the oil boom.

This created too much supply and prices came crashing down to under $30 a barrel where we saw them in 2016. But I also want to point out that this chart shows the average cost to produce a barrel of oil.

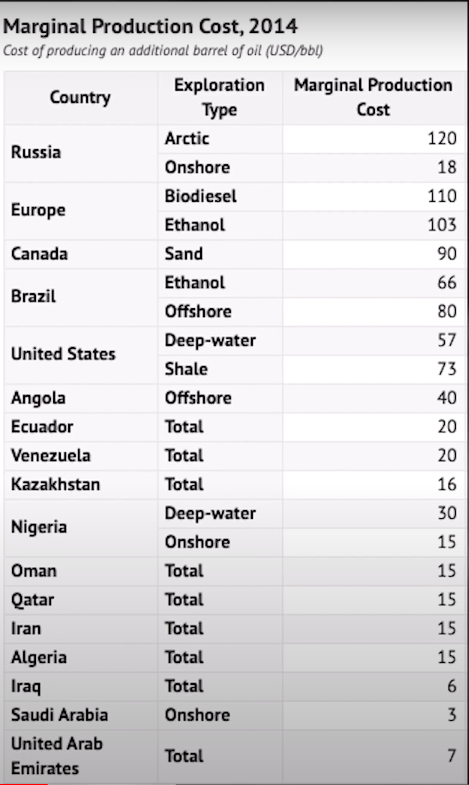

It's actually all over the map. Here is a chart of the costs per country to produce a barrel of oil.

It doesn't just fluctuate from country to country, it really depends on how they get the oil.

Look at Russia, Arctic cost them $120 a barrel while onshore only cost them 18 dollars.

Wow! You can see how dramatic the difference is. Starting in Russia with the Arctic at $120, and going all the way down to the UAE at $7 a barrel.

Look at the United States where the deep water costs $57 a barrel, but shale, $73 a barrel. You can just imagine what's happening to those shale producers now when oil's plummeted due to the coronavirus.

Speaking of the coronavirus, look at where it is today, 2020. Again, the price of oil dropped below $20 a barrel, while the cost to produce it on average is $60 a barrel, just like it was at the bottom of the bear market in 1998 and in 1970.

The Value Of Oil

This is where we're going to figure out what prices in the future will most likely do. It starts with the quote we all know well from Oscar Wilde. I've changed it up a bit, but you get the gist of it here.

-

What is the value of oil?

-

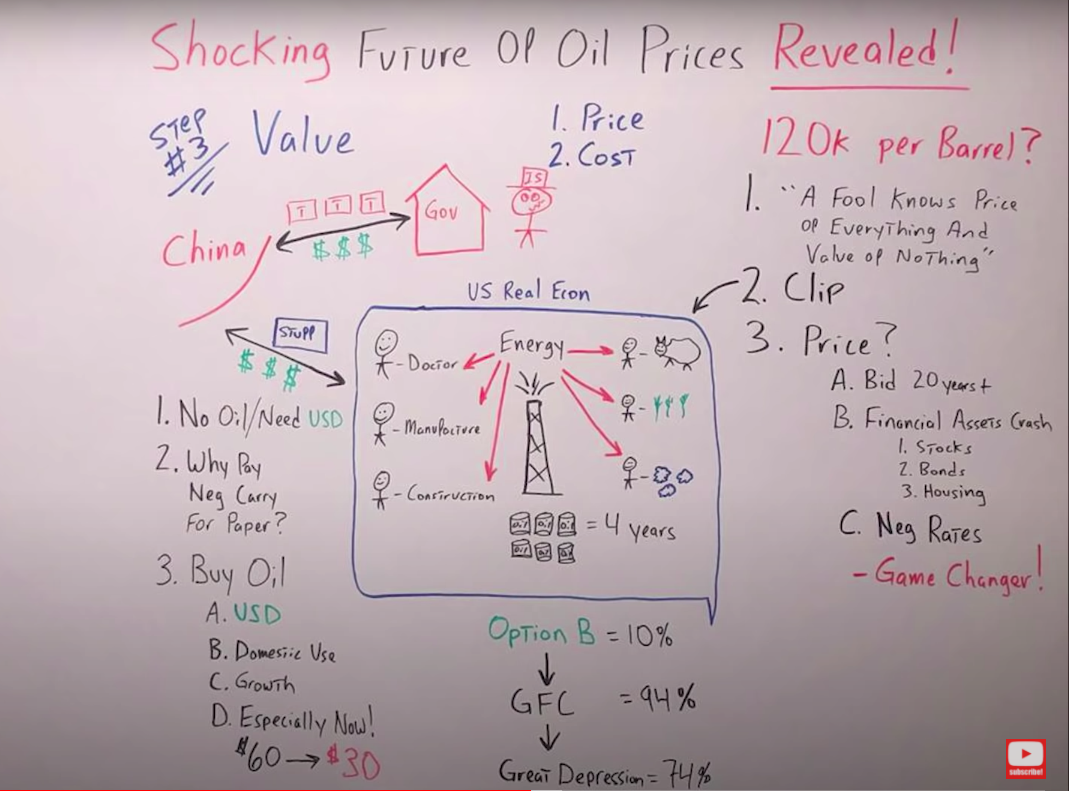

Is it $120,000 per barrel?

To find out, look at this little transcription of my recent interview with one of the leading experts in the oil space in the entire world, Art Berman.

Art Berman:

A barrel of oil, if you converted to kilocalories or some other form of energy, and do all the calculation for how many days a week do I work, it works out to be at four and a half years of human labor in a barrel of oil.

Now that's a huge bang for the buck.

A really important point that most people don't think about is, what's the difference between price, cost, and value?

Most of us use those interchangeably. But let's talk about a barrel of oil.

The price of a barrel of oil today is roughly $25. The cost of a barrel of oil, which is what it cost to actually get it out of the ground, is about $60 a barrel.

The value of a barrel of oil is the work that it contains. If we say that the median income of an American worker is $26,000 a year, then the value of a barrel of oil is like $120,000.

These three things, price, cost, and value are very different and you cannot find any other source of energy that's got a multiple of $25 price to $120,000 value.

That's why energy is the economy, and oil is the most productive form of energy. Therefore, money is nothing more than a claim on oil when you get right down to it or some other form of less productive energy.

When I hear people talk about, “Oh, well, we're going to go to an all-renewable economy.” Hey, I'm all for it. But let's understand that the bang for your buck, the energy density of solar or wind is a fraction of oil.

The value of the unit of energy produced from the solar wind is maybe 10% of what's in a barrel of oil.

So, if you're good with that, if you're willing to run a society that has 90% lower productivity, if you want to think about it that way, that's just great. Let's do it.

But it's going to be a very poor world on 100% renewables.

(End Of Transcript)

To better understand exactly what Art is talking about, let's go back to the example of the real economy. This the United States economy.

On the right, I drew a farmer that produces cows, corn, and cotton.

They produce so much stuff it allows other people in the economy to do things like being a doctor, manufacturer, or a construction worker because they don't have to produce their own food or cotton for their clothing.

As a result of the productivity of these individuals on the right and the left for that matter, the entire society gets richer.

As each individual is more productive, it allows others in society to do things that weren't being done before.

If you look at an example of the United States, back in the 1800s or the 1700s, every single person was a farmer. You didn't have a choice.

You had to grow your own food because very few people could grow more than they needed to consume. But all of a sudden you have people growing a lot more food. And this allowed the economy to expand.

Art Berman points out, the reason we're so productive is that oil is such a dense source of energy. It all starts with oil, without it, the people on the right or the left couldn't be near as productive.

They couldn't produce as much stuff, goods, and services. Let's say there's another option for energy, an option B that's 90% less dense than oil.

That means productivity, the amount of goods and services we could produce in the economy would also go down by 90%. Well, let's just think this through.

If you watched my interview with Jim Bianco, you know that during the GFC, our output of the entire economy went from 100% down to 94%.

Think of how much pain we experienced and that was just a drop of 6%. To give you even more context, in the Great Depression the economy went from 100% down to 74%.

What would happen to today's society, the quality of life, the standard of living, if it went from 100% all the way down to 10%?

I don't care how green it is. I don't care how bad oil is.

There's no way that as a society we would be willing to go down to that level. It's just too much of a cost.

What's going to happen to the price of oil in the future?

Well, there's definitely going to be a bid for at least the next 20 to 30 years when we look at what the damage would be to the real economy if we move to an alternative source of energy, especially if the value of oil is $120,000 a barrel, that's for sure.

But also, let's go back to where we talked about these bull markets in oil having a lot to do with asset bubbles deflating or crashing.

People don't want anything to do with financial assets, which include stocks, bonds, and housing.

-

What do they do?

-

What have they done in the past?

They've looked to commodities just like oil.

Let's take it a step further. Let's get outside of the box and think about how negative interest rates might affect the price of oil. This, I think, could be a game-changer that nobody is talking about.

Right now, China produces a lot of the stuff we consume in the United States. We know that well. So, in return for those things, we give them dollars.

So China takes those dollars, goes straight to your insolvent Uncle Sam, who is always drunk, and he is spending money like a drunken sailor.

He is producing plenty of treasuries for China to buy with the dollars we give them for the stuff they produce that we can consume.

So, China keeps these treasuries instead of dollars. Well, this is really a dollar-denominated asset that they need because they have a peg to the dollar. They always need US dollars.

That's a completely separate article, but you have to remember that for the sake of this example. They're buying an asset that's denominated in dollars, and they're getting a little bit of a return, an interest rate.

But, what happens if interest rates go negative?

Now, all of a sudden they have a negative carry. It actually costs them money to hold the asset denominated in US dollars.

They would be better just holding on to the cash itself, but then they might be worried about inflation.

What could they do in the future if this plays out?

Well, they could buy oil. It's denominated in US dollars. But instead of just being a piece of paper or a claim to your drunk insolvent Uncle Sam, it has a lot of use. They can use it domestically.

They can use it to grow and expand, whether you like it or not, whatever they're doing in Africa and South America it all requires a lot of oil.

Especially now that the cost of oil is $60 a barrel and the price is only $30 a barrel. It's a total no brainer. If we combine all the factors together, the price is a lot lower than the cost.

We could see all of these asset bubbles come crashing down. So, people are driven to buy something that's tangible, something they can use in the real economy, like commodities and oil.

And you get negative interest rates, which prompts all of these other countries outside of the United States that need dollars, that typically buy treasuries, now, all of a sudden, it's a lot smarter decision for them to buy oil.

You have all these demand components coming together at once, which will definitely drive the price of oil over its production cost at $60, it could take it to $100, $200.