Will the housing market crash in 2020?

There is much discussion about a potential 2020 real estate crash in the United States and possibly the rest of the world. Who would have thought a virus from a bat could wreak such havoc on the global economy?

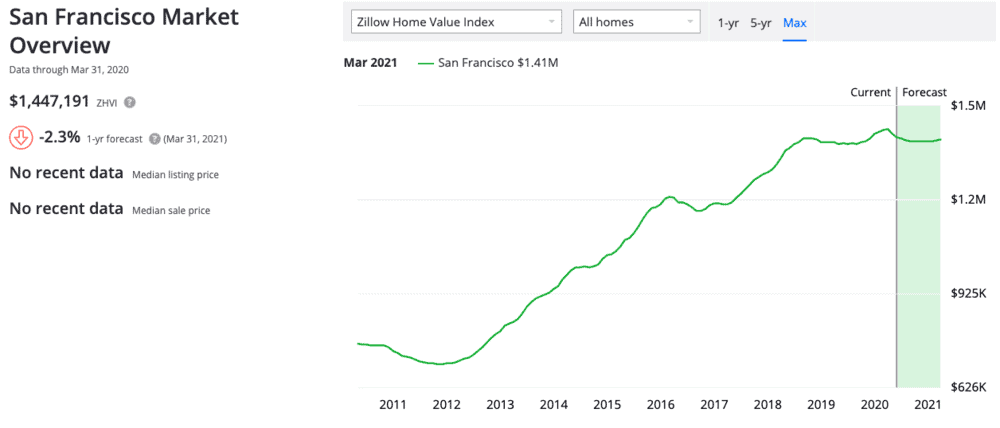

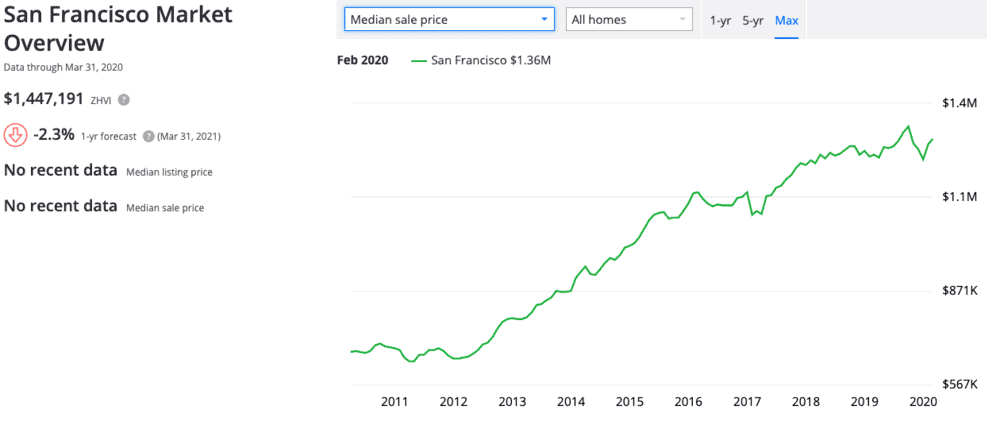

Though the real estate market might not completely crash as a result of the coronavirus, also known as COVID-19, it is likely to cause a meaningful reduction in home prices, especially in areas such as San Francisco where real estate prices are inflated.

However, the pressing question is when such a reduction in home prices will occur and how deeply prices will be cut?

How is the real estate market?

Thanks to coronavirus, real estate purchases, and sales have slowed to a crawl. However, prices are not going down simply because the coronavirus is on the loose.

Rather, most property owners interested in selling are holding on tight, waiting for the market to flatten out in the weeks or months ahead. Prices are not being reduced as significantly as some expected.

Furthermore, home-seekers are hesitant to roll out significant bids on properties up for sale as there is the potential for a much more considerable price decline in the months and years ahead.

However, every economist worth his or her keep will admit there is a housing bubble in which limited supply has sent prices skyrocketing to absurd levels, especially in in-demand markets such as New York City and Silicon Valley.

The Federal government’s $2 trillion stimulus package has the potential to put a halt on mortgage payments for upwards of an entire year as long as the loan is through Fannie Mae and Freddie Mac.

Fannie and Freddie are in the business of collecting home loans from residential markets throughout the country, packaging these loans together is similar to a sausage factory grinding meat and ultimately selling mortgage-backed securities.

Fannie and Freddie’s sausage hits the market with the hope that a party such as JP Morgan or a pension fund will buy it.

The “sausage” sold by Fannie and Freddie goes directly onto the pension fund’s balance sheet. The mortgage servicer subsequently takes payment from the homeowner and hands it off to the pension fund.

However, due to the coronavirus meltdown, countless homeowners are now unable to pay their monthly mortgage. The failure to pay these loans makes the servicer of the mortgage liable.

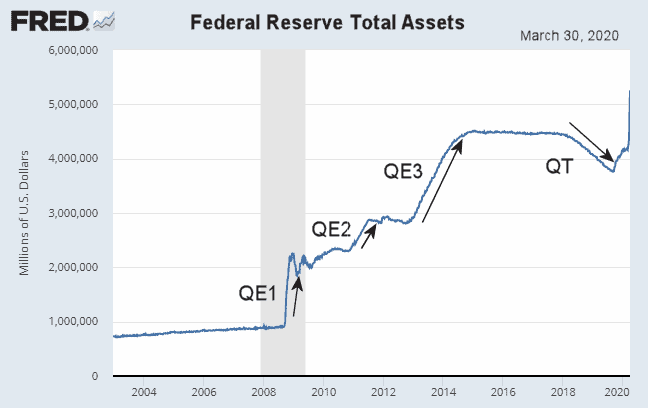

This is precisely why mortgage servicers throughout the country are seeking bailouts. It appears as though the Federal government is willing to accommodate this request by printing “funny money” out of thin air.

The Fed Bailouts: Money for Nothing

Though the Fed has not explicitly stated it will bail out the country’s mortgage servicers, there is a good chance such financial relief is on its way.

Though the Fed has not explicitly stated it will bail out the country’s mortgage servicers, there is a good chance such financial relief is on its way.

The alternative is for the servicer to fail, causing Fannie and Freddie to fail and our nation’s all-important pension funds to bust.

It is quite clear the Fed is willing to print as much funny money as necessary to buy up the aforementioned “sausage”, generating artificial demand.

Part of the logic behind printing such funny money out of thin air is it helps keep loan interest rates at reasonable levels.

The truth is these much-discussed interest rates should increase when mortgage payments are not paid in a timely manner.

However, if interest rates were to increase in accordance with natural market dynamics, they would reach a point at which few parties would be willing to borrow money, bringing the housing market and much of the economy to a grinding halt.

This is precisely why more and more funny money will be printed and injected into the economy.

The Fallout From Government Interference

Though the government’s interference with market dynamics will certainly keep interest rates stabilized, there will be some consequences to these actions.

Plenty of mortgage brokers are buying hedges just in case interest rates creep upward due to a potentially slow Fed response or other factors.

If interest rates decrease, these hedges will decrease in value, spurring a margin call that brokers might not actually be able to cover.

This means mortgage brokers will approach the Fed, hat-in-hand, requesting a bailout, insisting government interference in the market caused interest rates to decrease to unreasonable levels. If such a bailout does not occur, new loans won't be provided those looking to borrow for a home purchase.

If new buyers do not enter the market, the entire real estate market is likely to implode. In other words, the Fed is likely to do everything possible to keep interest rates low, even if it takes the printing of an egregiously large sum of funny money to bail out mortgage brokers, pension funds, and Fannie and Freddie.

When is a good time to buy a house?

Even if the Fed succeeds in keeping interest rates low or stagnant, home prices across the nation are likely to gradually decrease across the next half-decade or even longer.

Expect more dramatic drops in cyclical markets like California. This could start happening as soon as 2021.

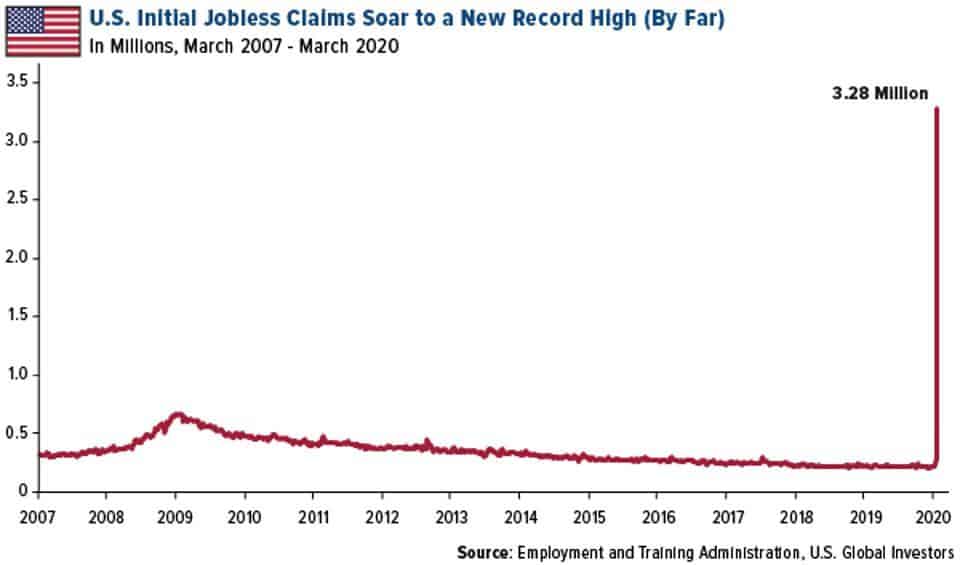

The bottom line is we are looking at a lengthy period of high unemployment combined with inflation for consumer goods.

Such stagflation results from the aforementioned printing and injection of funny money into the economy along with a reduction in operating businesses.

Fewer product and service sellers mean the cost of consumer goods/services will spike due to decreased competition.

However, the rise in the cost of goods will chew up that much more consumer discretionary income.

Unemployment rate

Add in the fact that unemployment is likely to hover around 10% or higher for the foreseeable future and the end result is less money to spend on homes.

Let’s assume home prices decrease as a result of the dynamics detailed above. Those looking for a home in an overpriced market such as San Diego, San Francisco or Austin are likely to find price tags are reduced by a considerable margin in due time.

Those who live in parts of the country such as Syracuse, NY, where home prices have gradually crept upward, might not see such a dramatic reduction in cost.

Furthermore, the decline in home prices across the board, regardless of location, is unlikely to occur within a couple of months or even a year’s time.

Prospective sellers will hesitate to significantly reduce the price of their home or even list their property for sale until it becomes increasingly clear the bubble is in the process of bursting and prices are likely to continue dropping in the months and years ahead.

The number of new homes listed for sale decreased by an astonishing 34% in the week ending March 28 compared to the same period of time one year ago.

As explained in this informative article from Redfin, potential home sellers are ready to accept a slightly reduced price in the aftermath of the coronavirus outbreak. Redfin reports the median price tag on houses listed for sale has dropped 6% in a week’s time. This trend is likely to continue as we segue into an economic recession.

Furthermore, Redfin also reports pending home sales dropped more than 40% in recent weeks. The real estate market is likely to gradually decrease in price, possibly across a period of 3-5 years or even longer as homes slowly make their way to the listings, albeit at reduced prices.

The moral of this story is home-seekers should not immediately jump into the market when prices begin to decrease this summer or fall.

Though home prices will generally trend lower across the country, there probably won’t be significant reductions until it becomes clear we are in the midst of a lengthy recession or possibly even a depression.

Should you sell or rent your house?

Alternatively, those considering selling their property should be aware of the fact that it will become increasingly difficult for home-seekers to obtain a reasonable mortgage interest rate and additional terms in the months and years ahead.

Those who live in overpriced markets such as San Francisco should give serious consideration to selling sooner rather than later as the real estate bubble is likely to burst in due time.

Fail to sell sooner rather than later and prices will gradually re-adjust as more prospective sellers get a sense of just how bad the economic carnage really is.

This means the cost of real estate in linear housing markets in which the cost of homes tends to increase in a straight line across posterity, rather than undulate, is likely to slightly decrease across the next half-decade.

If you own a single-family home in a linear market, then it might be worth keeping and renting out.

If your property has an RV ratio of 1% or more, and it's in a good neighborhood, then it's probably a good idea to rent it out, for a cashflow.

The cost of real estate in non-linear markets in which there is a significant undulation in home prices has the potential to decrease faster and much more sharply simply because the market is that much more dynamic.

The Cost of Shelter Vs. the Cost of Luxury Living

As we move forward into an increasingly unpredictable and volatile economy, more people will be willing to pay for shelter as opposed to luxurious accommodations.

This means the cost of renting/owning a simple apartment, ranch style home or other basic living space is likely to stagnate or slightly decrease, depending on the specific location.

However, the cost of lavish living spaces such as an upscale condominium in Silicon Valley or a McMansion in or near a large metropolis such as New York City is likely to decrease by a meaningful margin in the years to come.

The bottom line is people will be willing to pay for a roof over their heads during uncertain economic times yet they will be hesitant to shell-out their hard-earned money or take on a large home loan for a luxurious or especially spacious home.

Should You buy a house now?

Buying a home is a long-term investment, typically made when an individual or newly-married couple are confident in their ability to make a living and also have confidence in the economy as a whole.

The fact that the coronavirus has quashed non-essential economic activity for the foreseeable future is likely to considerably reduce the demand for home loans.

Even those who are gainfully employed during the COVID-19 outbreak will likely be hesitant to take out a 20 or 30-year mortgage that ties them down to one location for the prime earning years of their life.

In other words, more and more people will favor renting an apartment or a house rather than buying one. It is quite possible the demand for homes will decrease up until the point at which the economy shows signs of rebounding.

Is the housing market going to crash or will Millennials and Generation Z Come To The Rescue?

Some economists insist we can prevent a real estate market crash if young adults step up to the plate and buy homes rather than rent them. Those who should be buying their first home – millennials and some members of Generation Z – might be too financially shell-shocked to take the plunge.

These young adults faced the Great Recession of 2008 upon college graduation and must now endure the coronavirus recession or even depression as they transition to their late 20s and 30s. This is quite the 1-2 economic punch that many cash-strapped, debt-laden millennials simply will not be able to endure.

If millennials were not the largest age cohort in the United States, their lack of savings and risk-tolerance would not be as much of a problem.

However, even if a large percentage of those in the millennial and Generation Z age cohorts were willing to take on the debt necessary to buy a home, there is a good chance they would be denied the loan.

Lenders are tightening home loan restrictions in the aftermath of the coronavirus outbreak. As an example, JP Morgan Chase is now requiring a FICO credit score of 700 along with a 20% down payment on the home for mortgage loan approval.

If millennials refuse to take on even more debt, choosing to rent and save rather than spend and buy, the economic recession will likely continue, possibly spiraling into a depression that sends home values even lower in years to come.

Brace yourself – the real estate market is poised to endure a mini-crash that will reverberate throughout the rest of the economy for years to come.